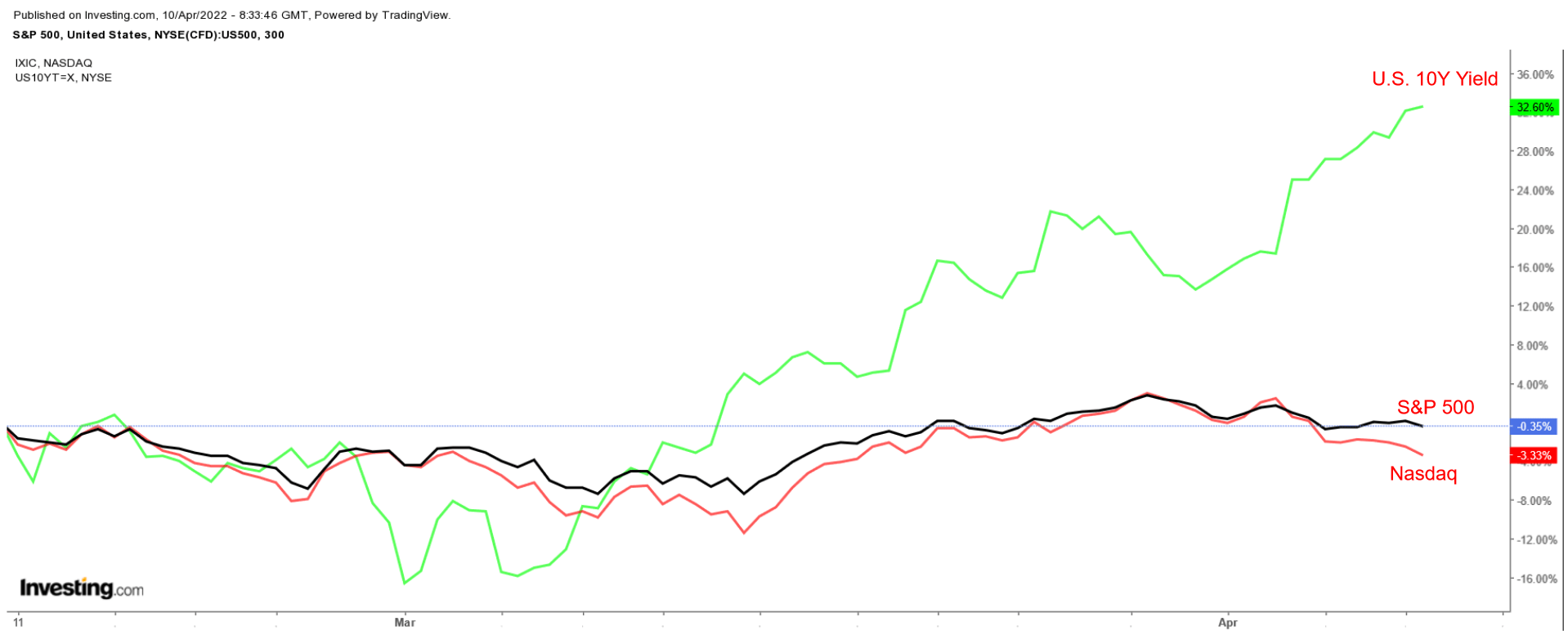

Stocks on Wall Street ended mixed on Friday, with the major averages suffering their second straight weekly decline as a hawkish Federal Reserve and surging Treasury yields took their toll.

The U.S. 10-year bond yield jumped nearly 30 basis points for the week, closing at a fresh three-year high above 2.7%, following the release of the FOMC minutes from last month’s meeting.

S&P 500, NASDAQ, And U.S. 10-Year Chart

S&P 500, NASDAQ, And U.S. 10-Year Chart

While the U.S. stock markets will be closed this coming Friday for Good Friday, the holiday-shortened week ahead is expected to be another busy one, given the start of Wall Street’s latest earnings season, which sees names like JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and Delta Air Lines (NYSE:DAL) all report their latest financial results.

There is also key economic data on the agenda, including the latest consumer price index inflation report and retail sales figures, making the coming week a potentially market-moving one.

With that in mind, we’ve highlighted one stock likely to be in demand and another which could see further downside this week—but remember, our timeframe is just for the upcoming week.

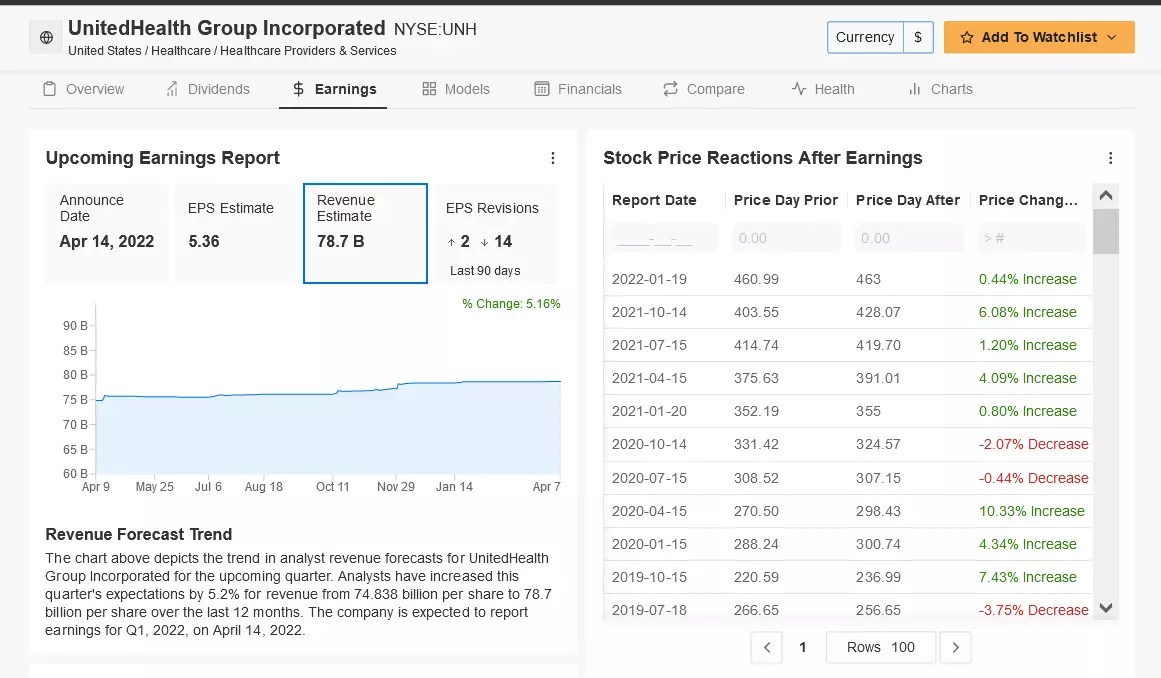

Stock To Buy: UnitedHealth Group

Shares of UnitedHealth Group (NYSE:UNH) could see increased buying activity in the days ahead as the largest U.S. health insurer is forecast to deliver solid earnings when it releases its Q1 financial results ahead of the opening bell on Thursday, Apr. 14.

Consensus expectations call for the healthcare juggernaut to post first quarter earnings per share of $5.36, improving 1% from EPS of $5.31 in the year-ago period.

According to InvestingPro+, the Minnetonka, Minnesota-based corporation—whose shares jumped to their best level on record on Friday—has topped Wall Street’s profit estimates for an astonishing 33 straight quarters, dating back to Q1 2014.

Meanwhile, revenue is anticipated to climb roughly 12% year-over-year to $78.7 billion, benefiting from robust Medicare Advantage membership additions and a strong performance in its Optum business, which manages drug benefits and offers healthcare data analytics services. If confirmed, UnitedHealth’s quarterly sales would mark the highest total on record.

UNH Earnings

UNH Earnings

Source: InvestingPro

As such, investors are hoping UNH’s management will maintain its upbeat view regarding its full-year outlook for fiscal 2022 as the diversified healthcare company continues to benefit from favorable consumer trends amid the current environment.

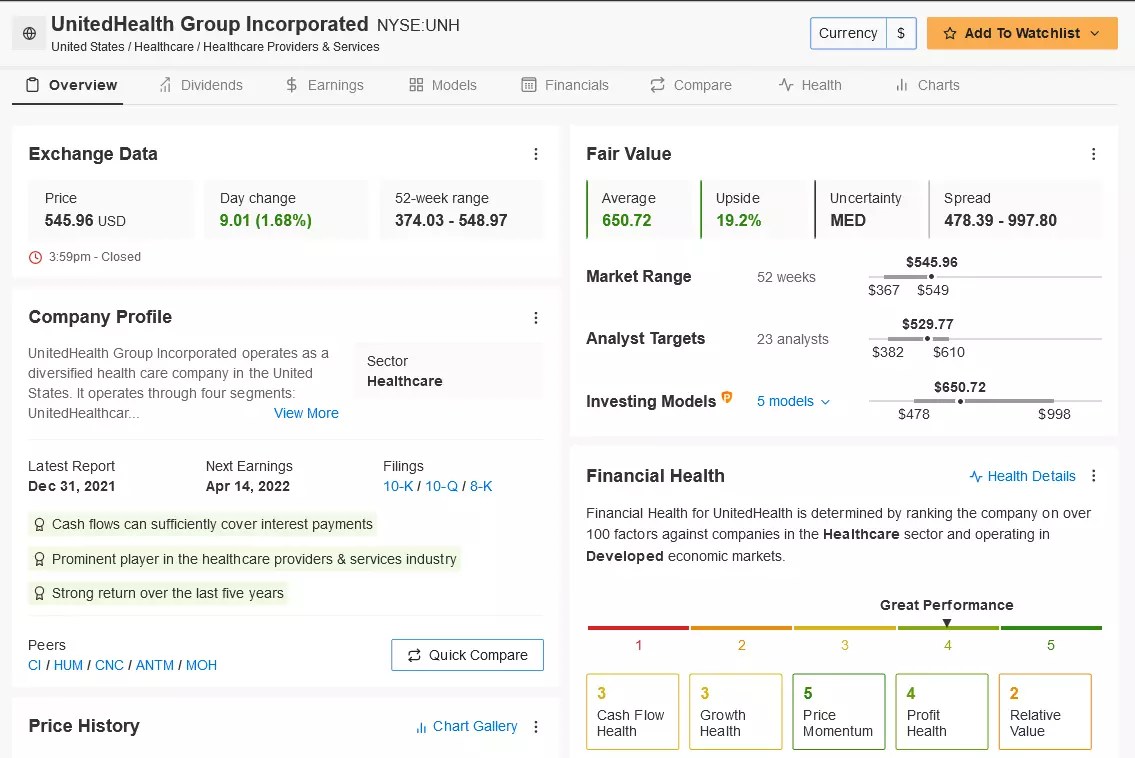

UNH climbed 6.5% last week to score its biggest weekly gain since November 2020 and closed Friday’s session at an all-time peak of $548.97. At current valuations, UnitedHealth has a market cap of roughly $513.7 billion, making it the biggest name in the managed-care sector and the ninth most valuable company trading on the U.S. stock exchange.

UNH Daily Chart

UNH Daily Chart

Despite the broader market slump, UNH shares have climbed 8.7% year-to-date to easily outperform the comparable returns of both the Dow Jones Industrial Average and the S&P 500 over the same timeframe.

In addition to strong fundamentals, sentiment on the market leader has picked up recently as investors dump unprofitable tech stocks with lofty valuations and pile into value names with stable earnings due to growing fears over a potential recession resulting from the Fed’s aggressive tightening plans.

UNH Summary

UNH Summary

Source: InvestingPro

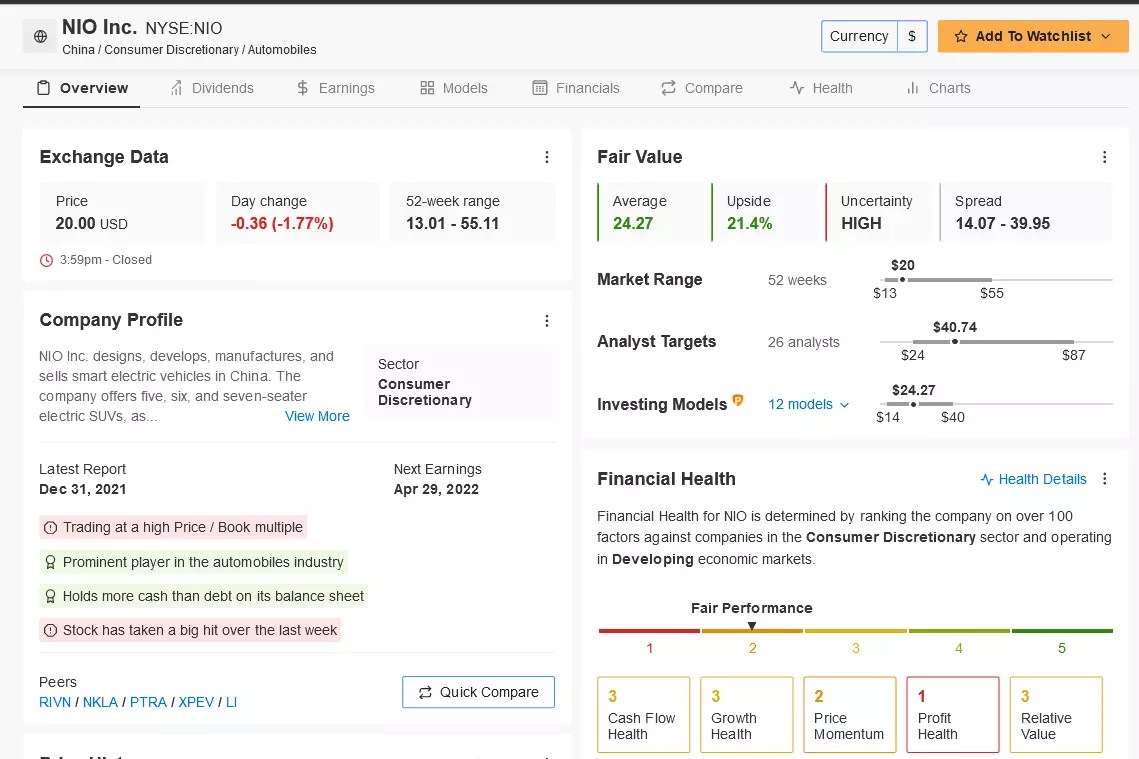

Stock To Dump: NIO

NIO (NYSE:NIO) shares are expected to suffer another challenging week, with a potential revisit to recent lows on the horizon, as investors react to a plethora of negative developments plaguing one of China’s largest electric vehicle makers.

NIO Summary

NIO Summary

Source: InvestingPro

The latest round of bad news came after the EV company announced that it suspended production at its Hefei, Anhui province factory—with the resumption date unknown—as China’s drastic measures to contain the ongoing COVID outbreak disrupted operations at its supply chain partners. Mentioned in a statement issued by the company on Sunday,

“Since March, due to reasons to do with the epidemic, the company’s supplier partners in several places including Jilin, Shanghai and Jiangsu suspended production one after the other and have yet to recover. There will be a delay in the delivery of vehicles for many customers in the near future, and we ask for your understanding.”

Taking that into account, we expect the downtrend in NIO to continue in the days ahead.

NIO Daily Chart

NIO Daily Chart

Source: Investing.com

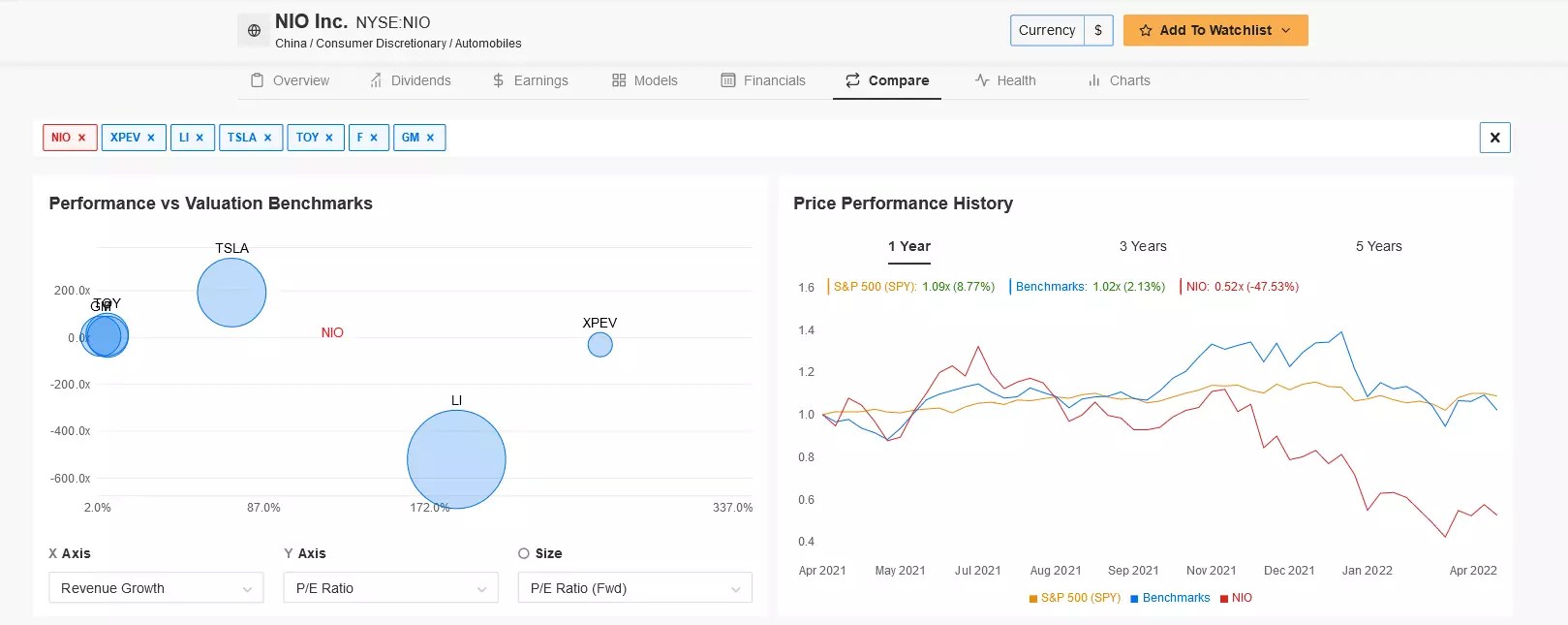

NIO sank to its lowest level since August 2020 of $13.01 on Mar. 15, ending at $20.00 on Friday, earning the Shanghai, China-based EV company a market cap of roughly $33 billion.

At current levels, NIO is down almost 37% since the start of 2022 and 47.5% in the last 12 months, trailing the comparable returns of domestic rivals such as Xpeng (NYSE:XPEV), and Li Auto (NASDAQ:LI), as well as other notable global automakers, including Tesla (NASDAQ:TSLA), Toyota (NYSE:TM), Ford (NYSE:F), and GM (NYSE:GM).

Even more alarming, NIO shares have now pulled back approximately 70% since touching a record high of $66.99 in January 2021, amid an aggressive reset in valuations throughout the entire EV sector.

NIO Peer Comparison

NIO Peer Comparison

Source: InvestingPro

Source: Investing.com