Microsoft is a high-quality, lower-risk tech giant with a wide economic moat

The company is attracting more large deals to its Azure cloud-computing software

The majority of Wall Street analysts remain highly bullish on MSFT growth prospects

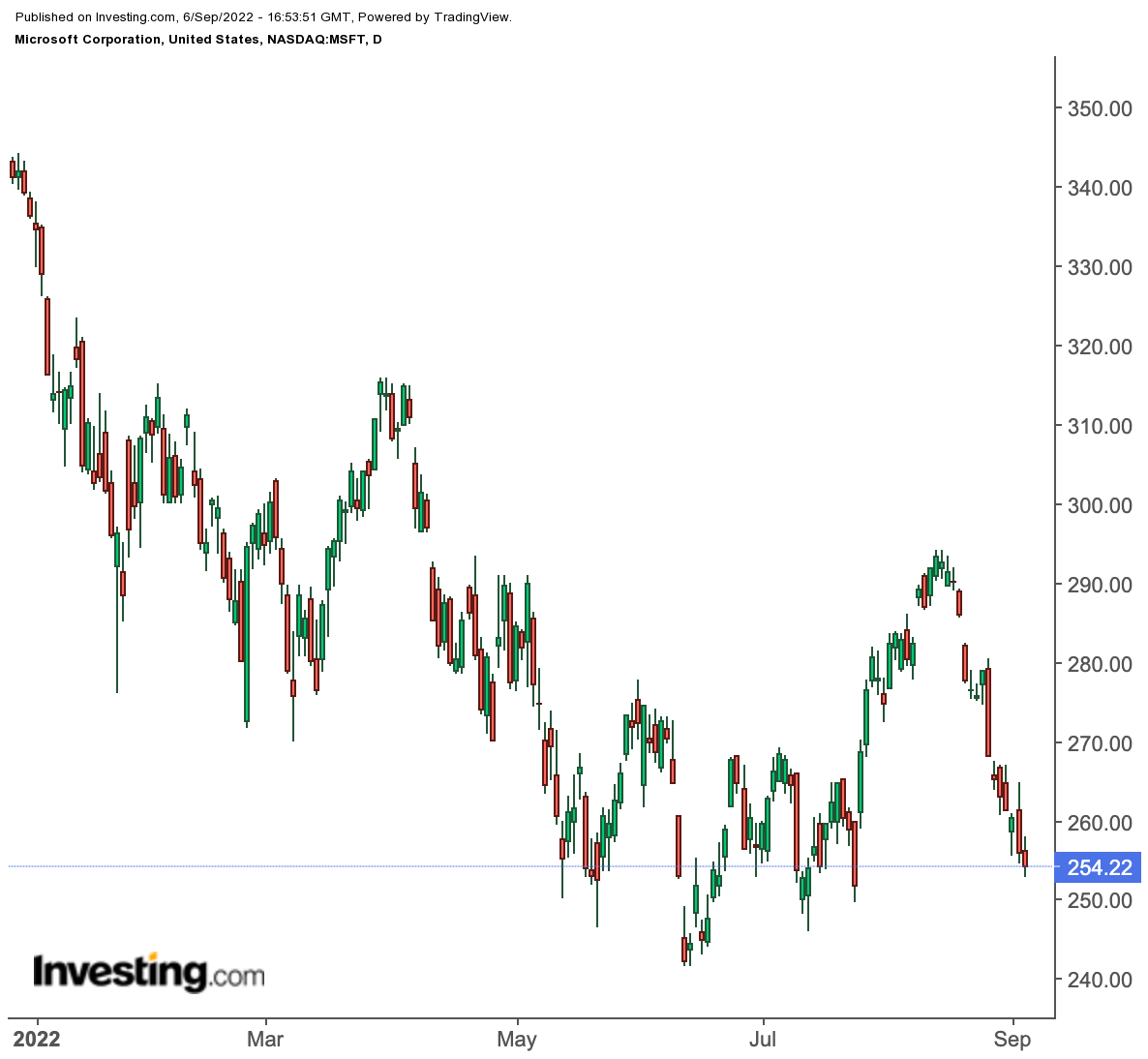

After a powerful summer rally, investors are again turning bearish on some high-profile companies. Shares of Microsoft (NASDAQ:MSFT), the U.S.’s second-most valuable company, are down close to 25% this year as the sell-off in growth stocks resumes amid recession fears.

MSFT Daily Chart

MSFT Daily Chart

The current bearish spell comes after two years of incredible returns. In 2021 alone, the software giant’s stock gained more than 50%, nearly double the expansion of the benchmark Nasdaq 100.

How long the current weakness lingers is anybody’s guess, but If you’re looking for safety in tech, Microsoft is a safe bet in the trillion-dollar mega-cap club that includes Apple (NASDAQ:AAPL) and Amazon.com (NASDAQ:AMZN).

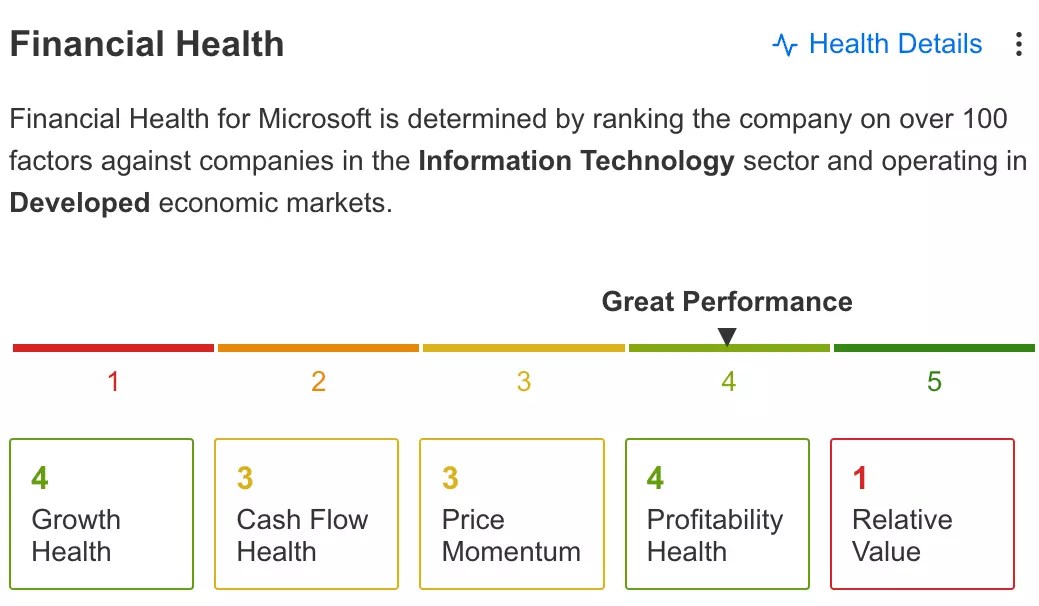

The Redmond, Washington-based behemoth is a high-quality, lower-risk tech giant with a wide economic moat. The software maker is among the companies best positioned to weather economic disruptions due to its strong pricing power and diversified product base. According to the InvestingPro model, the company scores a “Great Performance” with respect to its financial health.

src=

src=

Source: InvestingPro

Furthermore, the company’s latest earnings report provides strong evidence that CEO Satya Nadella and his team are well-positioned to produce impressive growth in this challenging economic environment.

The software giant expects revenue and operating income to increase at a double-digit pace for fiscal 2023, which ends next June, despite slowing demand in some areas and currency headwinds hurting global income.

A Major Growth Driver

The company’s cloud computing business has been the primary driving force behind the stock’s 285% advance in the past five years—a period in which Nadella invested heavily to grab a greater market share in this high-margin business in which MSFT competes with Amazon.

Microsoft is attracting large deals to its Azure cloud-computing software and moving clients to pricier versions of Office cloud programs. The turbulent economic picture will lead some customers to gravitate to Microsoft’s products and to cloud software more generally because it can help them control what they’re spending on technology, Nadella said on the company’s latest conference call.

He added that the public cloud would be an even bigger winner in this challenging macroeconomic environment.

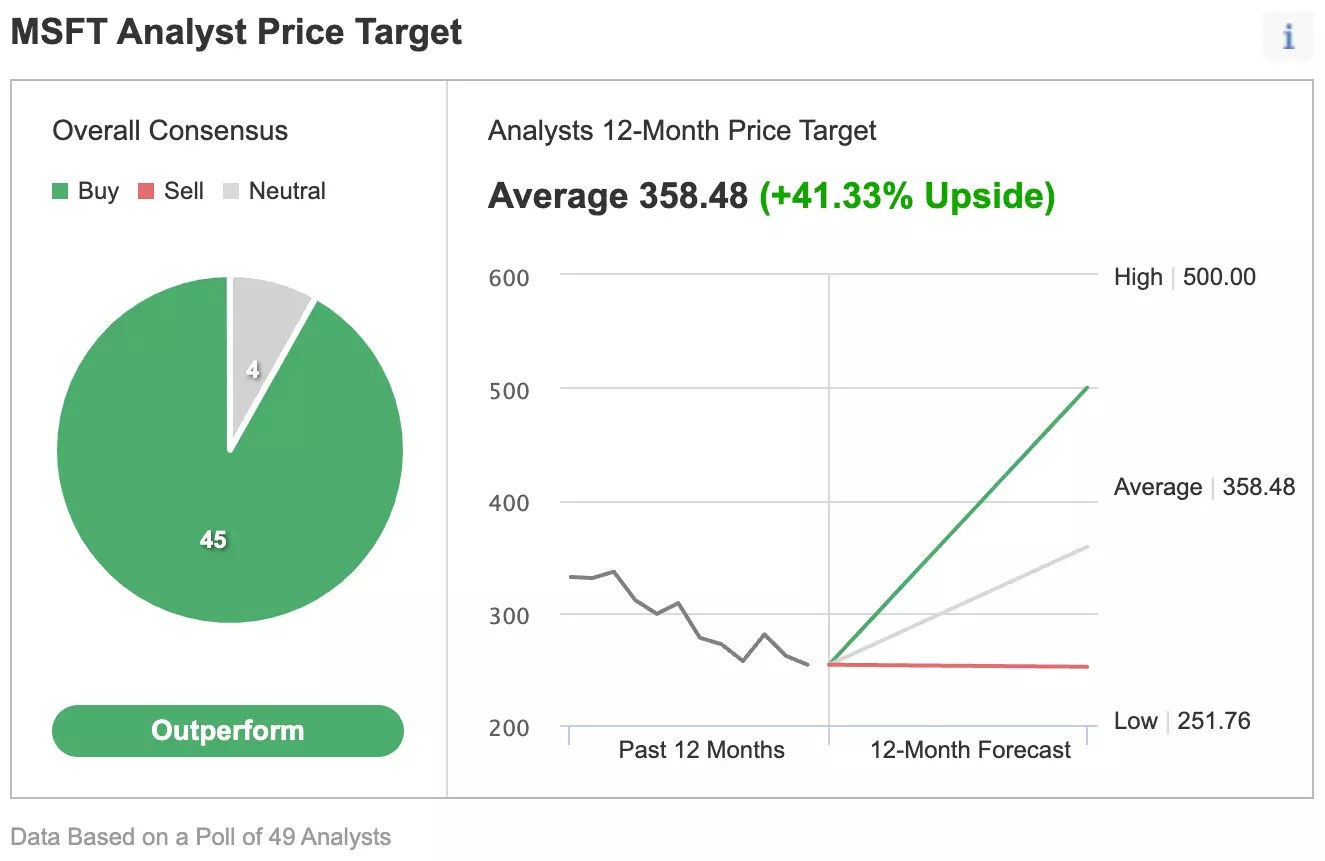

This momentum in the cloud business is one of the main reasons that most Wall Street analysts remain highly bullish on MSFT growth prospects. In an Investing.com poll of 49 analysts, 45 rate the stock a buy with a 12-month consensus price target which implies more than 41% upside potential.

MSFT Consensus Estimates

MSFT Consensus Estimates

Source: Investing.com

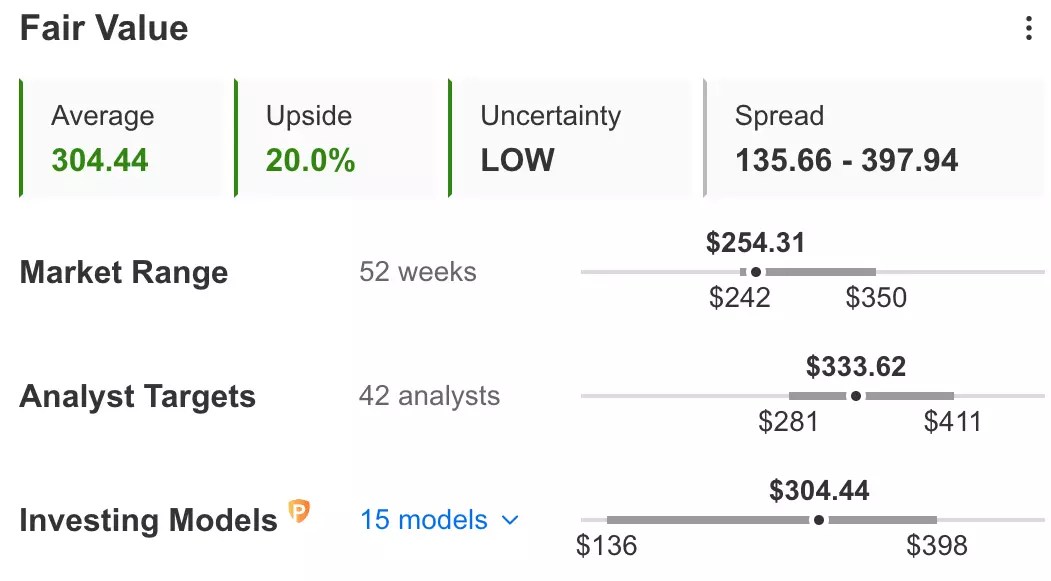

Similarly, according to several valuation models, including P/E or P/S multiples or terminal values, the average fair value for MSFT stock on InvestingPro stands at $304.44, a potential 20% upside from the current market value.

MSFT Fair Value

MSFT Fair Value

Source: InvestingPro

MSFT is one of the seven stocks in the UBS “conviction” list when a recession looms due to its better-than-average free cash flow yield and robust forward sales growth.

In a note last month, JPMorgan said that the company is “weathering the storm” better than other players, with the degradation in earnings as gradual and relatively small in magnitude compared to the broader tech landscape.

Microsoft’s strong balance sheet and dividend program offer another solid reason for investors looking to take refuge in the current uncertain times. MSFT currently pays $0.62 quarterly for an annual yield of 0.97%. But with cash reserves exceeding $130 billion, the company has enough firepower to support its stock through share buybacks and dividend hikes.

Bottom Line

MSFT stock continues to offer substantial value in these uncertain times. The company is better positioned to weather the economic downturn than its peers due to its diversified business model and growth momentum in its cloud business.

The current weakness in MSFT stock offers a chance to take a position in this excellent business.

Disclosure: The writer owns shares of Microsoft.

Source: Investing.com