(Bloomberg) — Fuel markets are signaling to suppliers that they should avoid holding on to products at all costs, despite the Biden administration’s willingness to consider banning exports as an extreme measure to help build stockpiles.

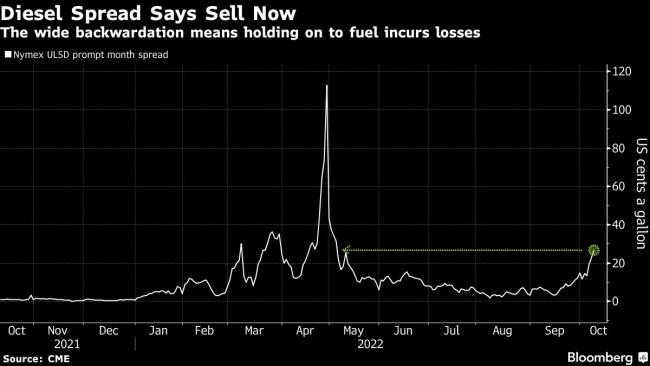

Diesel futures trading in New York have shifted into the widest backwardation in five months — meaning next-month deliveries are priced at a discount to prompt. In such a market structure, suppliers risk losing 27 cents for each gallon of diesel they hold by the end of the month, compared with less than 1 cent at the same time last year.

The bullish spread not only reflects supply tightness — distillate inventories in the New York Harbor region are about a third of typical levels for this time of year — but it also exacerbates the shortage by discouraging stock-building.

The US northeast relies on diesel for heating homes, and it’s also the fuel used in trucking goods on highways across the country. Winter supply has never been more precarious as regional refinery work and a lack of imports — Russia played a major part in supplying diesel to New York last winter — compound already low stockpiles. The average diesel retail price in the US rose above $5 a gallon last week, a 46% increase from a year ago, according to auto club AAA.

In gasoline markets, which are also being targeted by the White House, the backwardation in futures is about 14 cents a gallon, compared with less than 5 cents a year ago. That comes as retail prices nationwide have started climbing again since mid-September after a 98-day streak of declines.

©2022 Bloomberg L.P.

Source: Investing.com