AAPL

+0.60%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Apple (NASDAQ:AAPL) is scheduled to release earnings on Thursday after the closing bell. Analysts forecast EPS of $1.26 and revenue of $88.76 billion, compared to $1.24 and $83.36 billion year-on-year.

Perhaps, the most timely question is whether rising inflation and interest rates will impact Apple’s growth.

Based on results from American Express (NYSE:AXP) and Bank of America (NYSE:BAC), consumers are continuing to spend despite rising prices.

Does this mean that earnings from the world’s largest retailer, Walmart (NYSE:WMT) were lower because we are bottoming?

No. It does not.

It just means that an economy does not move in a straight line. Like single securities go up and down within a trend, so does the economy. For example, Australia just cut its economic growth forecast precisely because rising costs will lower consumer demand. In the UK, consumer confidence in October languished near historic lows. Canada’s finance minister offered a similar warning.

Apple depends on global sales, not just US sales. For now, let’s follow the money.

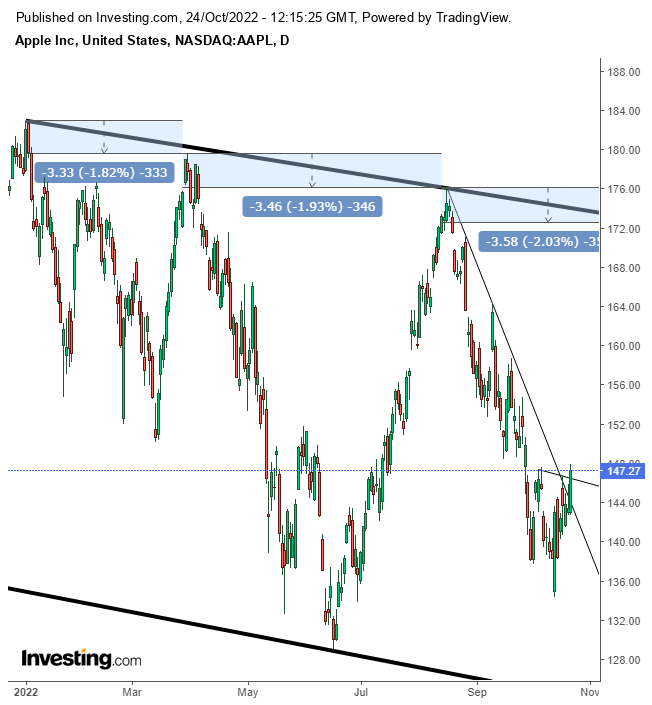

The average Tipranks target for Apple based on 28 analysts is $181.93. I have been openly contrarian to the popular opinion for a bottom every time one has been called. I have accordingly been providing bearish targets. However, now I’m providing a short-term trade setup within a medium-term downtrend.

Based on the technicals, I have been contrarian to Wall Street analysts, but I will join them in the short term.

Apple Daily

Apple Daily

Apple May have bottomed in the short term, perhaps completing a small H&S bottom. The price registered two rising peaks and troughs as the stock rebounded above its short-term downtrend line. Note the thick falling channel at the top and bottom of the chart.

Trading Strategies

Conservative traders should sit this out, as they only trade according to the primary trend.

Moderate traders would wait for the price to close above $150, then confirm the bottom with accumulation.

Aggressive traders may enter a long position.

Trade Sample – Aggressive Position

Entry: $147

Stop-Loss: $145

Risk: $2

Target: $157

Reward: $10

Risk-Reward Ratio: 1:5

Disclaimer: The author has no position in the instruments mentioned in this article.

Source: Investing.com