© Reuters. FILE PHOTO: A view of signage outside the European Central Bank (ECB) building in Frankfurt, Germany October 27, 2022. REUTERS/Wolfgang Rattay

AMZN

-6.80%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

UL

+2.33%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By Balazs Koranyi

FRANKFURT (Reuters) – European Central Bank policymakers stood firmly behind plans to keep raising interest rates even if that pushes the bloc into recession and stirs political resentment as fresh data pointed to higher than feared inflation.

The ECB doubled its deposit rate to 1.5% on Thursday and promised more tightening in the months to come in a bid to prevent sky high price growth from getting entrenched, rebuffing a round of government criticism that it was exacerbating the downturn.

Slight tweaks to the ECB’s message, like the admission a recession was possible or the omission of a reference to “several” rate hikes, had led some to think the bank may be getting cold feet. But policymakers on Friday appeared to be on message that rates will keep going up.

“It will go even higher in December and the first months of next year,” ECB policymaker Peter Kazimir said on Friday.

“We will cross the neutral rate — regardless of where anyone currently sees it — like a runaway train,” Kazimir, Slovakia’s central bank chief, said in unusually hawkish comments. “We need to get monetary policy into the so-called restrictive environment, at least for a certain period.”

Estonia’s governor Madis Müller and Gediminas Simkus from Lithuania also made the case for more action even if Bank of France head Francois Villeroy de Galhau attempted to temper the message, saying that December’s increase will not necessarily have to be 75 basis points.

More rate hikes are likely to irk the bloc’s political leaders, who fear that the ECB is inflicting pain on people already suffering from soaring energy prices.

French President Emmanuel Macron and Italian Prime Minister Giorgia Meloni have both expressed frustration with the ECB in recent days, arguing that its fastest ever policy tightening could intensify the downturn.

The flurry of ECB comments came just as fresh data pointed to inflation being even higher than feared.

The bank’s own Survey of Professional Forecasters, a key input in policy deliberations showed inflation, now running at almost 10%, holding above the ECB’s 2% target indefinitely and only falling to 2.4% by 2024.

Fresh inflation figures out of Germany, France and Italy on Friday all exceeded forecasts with only Spain coming in under expectations, suggesting price growth in the bloc as a whole likely accelerated, confounding expectations for a drop.

Italian inflation soared to 12.8% in October, Germany hit 11.6% while French inflation was 7.1%, all well above forecasts.

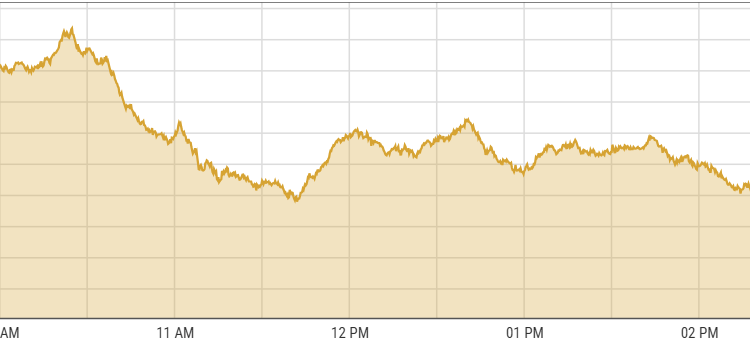

The string of data and ECB comments kept markets volatile on Friday.

Investors now see ECB rates peaking at around 2.75%, above levels near 2.5% seen on Thursday after the ECB’s rate hike and language tweaks.

But the peak was priced at over 3% just days ago, indicating that investors remain unsure just how high rates need to go to tame inflation. Yields on ten-year German government bonds, a benchmark for the bloc, jumped 13 basis points, erasing nearly all of Thursday’s fall.

RECESSION

The policymakers’ reinforcement of the rate hike message comes as a recession now looks almost certain, and will likely prompt a barrage of further criticism from European leaders.

The ECB’s survey predicted economic growth would total just 0.1% next year and there would be three quarters of negative growth starting with the third quarter of 2022, producing a cumulative decline of 0.7%.

But ECB chief Christine Lagarde pushed back on the criticism on Thursday, arguing that breaking inflation was the ECB’s chief mission and governments could help by providing targeted support for the most vulnerable.

Highlighting the risk, major global companies including Amazon (NASDAQ:AMZN), Unilever (NYSE:UL) and Reckitt Beckiser this week gave the starkest warnings yet on the challenges facing European consumers this winter.

“Fuel cost and the impacts of the Ukraine war are hitting the economies in Europe even harder than the U.S., and that’s showing up in consumer spend,” Brian Olsavsky, Amazon’s chief financial officer, told reporters. Unilever, maker of more than 400 brands including Persil detergent and Ben & Jerry’s ice cream, on Thursday also gave a dire assessment.

“Consumer sentiment in Europe is at an all time low,” Chief Financial Officer Graeme Pitkethly told reporters, warning of fears of a “confluence of events” with energy prices and inflation rising and households’ savings waning.

Source: Investing.com

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)