NDX

-0.43%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US CPI increased 7.7% year on year (yoy) in October, the lowest rise this year and half a percentage point lower than the 8.2% registered in September. Core prices—excluding volatile energy and food prices, which is the Fed’s preferred gauge—rose 6.3% yoy, or 0.3% month on month (mom), pulling back from a 40-year high, slower than the 0.5% expectation.

Since the technology sector has slipped the most this year, investors seem to have bought what they considered to be a sudden bargain after the CPI release.

However, even after the technology-led rally, which included the sector’s biggest weekly jump of the year, the Nasdaq 100 is down 27.45% year to date. Conversely, the Dow has retreated just 7.1%, and the S&P 500 fell 16.2%. Even the Russell 2000—which includes small caps, which also fall out of favor amid tightening—is only 16.1% lower for the year.

Also, among the S&P 500 sectors, Communications Services is by far the worst performer, having shed 35.6% of its value while the Technology sector also underperformed, sliding 23.4%.

So, investors vociferously cheered the sign of peaking inflation with a rush to increase risk. But remember it is unwise to rely on a single print.

Let’s see if the supply-demand balance warrants the current optimism.

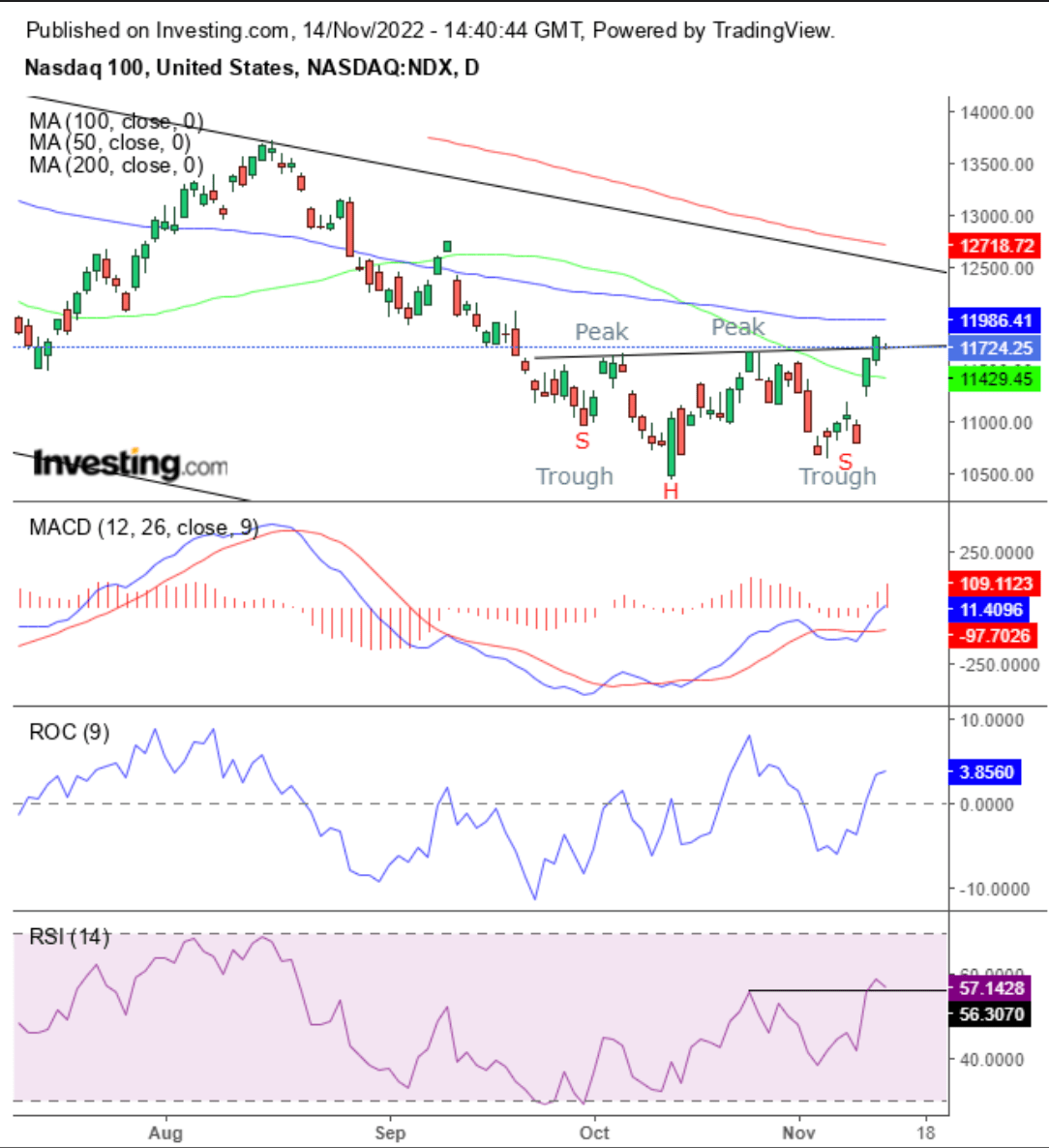

Nasdaq Daily

Nasdaq Daily

The Nasdaq completed a small H&S. Notice that the volume rose with the rallies, demonstrating where participation lies, as the trend registered an ascending series of peaks and troughs.

While the more sensitive ROC has yet to rise above its previous peak, the RSI and MACD both provided bullish crosses. The price crossed above the 50 DMA but is below the 100 DMA and the 200 DMA.

Let’s take a step back and see if the picture remains consistent.

Nasdaq Weekly

Nasdaq Weekly

Now, we realize that the bottom is just short-term, a correction within the medium-term downtrend framed within the falling channel.

As opposed to the daily volume, the weekly volume spiked with declines and dried up with rallies, demonstrating that there are more bears than bulls. The 50-week moving average (WMA) fell below the 100 WMA, but the price crossed above the 200 WMA after falling below it in Sep for the first time since 2010. I expect considerable volatility.

Trading Strategies

Conservative traders should wait until the short term realigns with the medium term.

Moderate traders would risk a long position if the price crosses the 100 DMA, then wait for a pullback demonstrating support above October highs.

Aggressive traders can commit to a long position, provided they accept the proportionately higher risk to reward of moving before confirmation and the rest of the market.

Trade Sample – Aggressive Long

Entry: 11,700

Stop-Loss: 11,500

Risk: 200 points

Target: 12,300

Reward: 600 points

Risk-Reward Ratio: 1:3

Disclaimer: At the time of publication, the author had no positions in the securities mentioned.

Source: Investing.com