SINGAPORE (ICIS)–China butadiene (BD) market continues to remain strong on the back of tight supply caused by domestic transportation restrictions and lesser volumes being offered by state-owned major supplier Sinopec, market sources said on Tuesday.

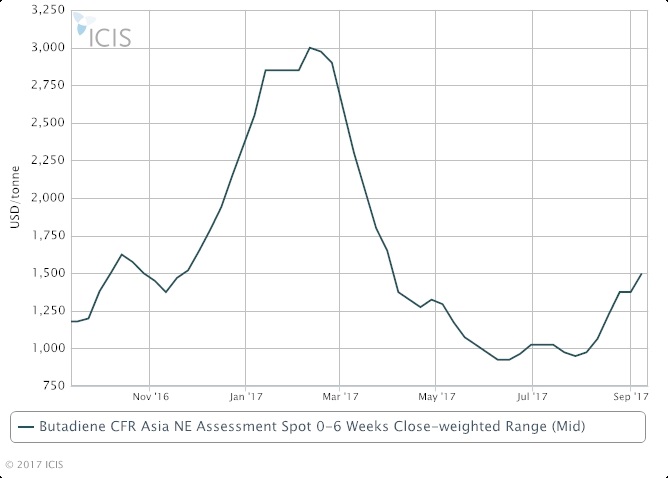

Local BD prices jumped by yuan (CNY)1,600/tonne from 31 August to CNY12,500-12,700/tonne DEL east China on 7 September, according to ICIS.

The Chinese authorities placed restrictions on goods transport from 26 August to 10 September due to the National Games which resulted in inventory pressure on BD producers and limited availability in the spot market.

To mitigate the inventory pressure, PetroChina Fushun Petrochemical and Liaoning Huajin TongdaPetrochemical in northeast China cut their offers unexpectedly at the end of August.

By cutting prices, the producers offered a sort of compensation for higher transportation costs due to the transportation restrictions.

As a result, domestic BD prices dropped on 30-31 August by CNY200-300/tonne.

However, soon afterwards Sinopec resumed its trend of raise prices. Other producers also hiked their offers soon after dropping them at the end of August.

The increase in prices was also attributed to limited BD supply in September as some contracts were adjusted downward because Sinopec needed BD to ensure its own synthetic rubber and styrene-butadiene-styrene (SBS) production.

On 8 September, Sinopec raised its domestic BD prices to CNY11,700/tonne ex-works in east China. This marks an increase of CNY3,500/tonne from its 9 August prices when it was offering BD at CNY8,200/tonne ex-works.

Meanwhile in the import market, prices are largely equivalent to domestic prices.

The shipments that will arrive later will be unable to cover the spot demand in the short term thus keeping supply tight.

The impact of the Hurricane Harvey on BD supplies in the US and any deep-sea cargoes from there is also of some concern to the domestic market in China.

According to initial estimates by ICIS, four BD units in the US have been affected by Harvey, accounting for more than half of the BD capacity in the US.

It may take some time to balance the US market and adjust the global cargo flow and this might affect the overall import market in Asia.

More than 20,000 tonnes of BD were scheduled to arrive in Asia in September and October from the US Gulf, but only about 14,000 tonnes have been confirmed to be on schedule.

Two parcels, totalling 9,000 tonnes, were heard delayed by about two weeks and are expected to arrive in Asia in the second half of October.

While some market participants grapple with limited supply, demand from the downstream styrene-butadiene rubber (SBR) and the polybutadiene rubber (PBR) sector is stable and the prices are largely equivalent to compound and mixed natural rubber (NR) prices.

Some market participants in the NR market are still optimistic about the price outlook for their products in in September-October due to BD’s strength.

Major BD suppliers in China include Liaoning Huajin, Fushun Petrochemical and Liaoyang Petrochemical, which concentrate in northeast China, as well as Sinopec and import sellers.

Top image: (LAT Photographic/REX/Shutterstock)