AKRON — The global synthetic rubber market is one where overly optimistic expectations have put the sector in a difficult position.

When things were good, producers put in too much capacity — particularly in China and elsewhere in the Asia-Pacific region. When growth rates didn’t meet these forecasts, however, that left the SR industry overall looking at operating rates that are below 70 percent, with many firms struggling to be profitable, according to Bill Hyde, senior director of olefins and elastomers for IHS Markit.

“That doesn’t mean that every producer is running at those low rates,” Hyde said, “but on average that’s where we think the industry is. There are some regions where operating rates are higher, and there are some producers, especially when you’re talking about polybutadiene and solution SBR, where they have products that are special grades. They are operating at higher rates, and some of them are expanding.”

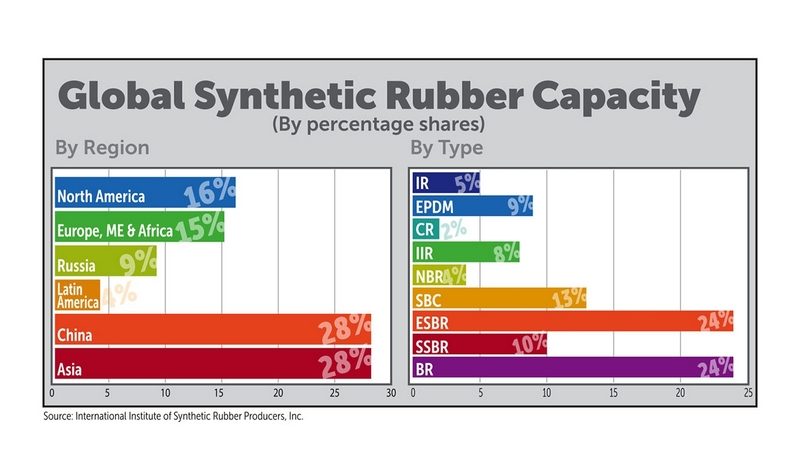

The International Institute of Synthetic Rubber Producers (IISRP) said the overcapacity is most prevalent among the tire elastomers, including butadiene (BR), solution SBR (SSBR) and emulsion SBR (ESBR), which collectively account for an estimated 58 percent of global capacity.

Houston-based IISRP puts the operating rates for all three SR types in the 65- to 67-percent range. It said there has been confirmation of BR facilities being idled in China, but said the operating rate is improving for this elastomer, as demand last year showed slight recovery in Asia-Pacific and the Europe, Middle East, Africa region.

It also said SSBR is showing an improving operating rate with demand improving in all regions. ESBR, however, still has a stagnant operating rate, with a slight demand recovery in Asia-Pacific.

On the bright side, global SR consumption is projected to grow from 2017-21 at an annual growth rate of 2.5 percent, said the IISRP, which has 23 producer members that collectively account for 80 percent of global SR production capacity.

“In general, we have a certain level of overcapacity worldwide, mainly focusing more in Asia-Pacific,” IISRP Managing Director Juan Ramon Salinas said. “Right now, there is a certain level of rationalization of capacity and consumption is growing. Now the situation is improving in general, but of course it will take a while.”

Mr. Hyde said this makes profitability difficult, particularly considering the volatile pricing of butadiene feedstock. From about October 2016 through April of this year, butadiene costs — for a number of reasons — spiked from roughly $1,000 a metric ton to about $4,000, before coming down to current levels of around $900 a ton.

“When it was at the high level, the rubber producers really struggled to pass that cost increase through. They didn’t have the ability to push everything through, partially because natural rubber pricing has been so soft.”

Asia-Pacific dominance

The SR industry is dominated by the Asian region, which accounts for an estimated 56 percent of global capacity, split evenly between China and the rest of Asia. By contrast, North America represents 16 percent, Europe/Middle East/Africa 15 percent and Russia 9 percent.

Asia-Pacific especially holds commanding capacity positions in ESBR, BR, NBR and styrene block copolymer, while supply is more evenly distributed in EPDM and SSBR.

Asia-Pacific, not surprisingly, was at the forefront of adding capacity when projections were for much stronger growth, said Roxanna Bauza-Petrovic, IISRP general director of programs.

“I think this happened a lot in China,” Ms. Buaza-Petrovic said. “China had a tremendous overinvestment in many of industries.”

She cited a report from Reed Business Information’s ICIS petrochemical business market analysts that outlined more than 15 materials that were experiencing weak operating rates. Besides rubber, others with deteriorating rates included such materials as polyvinyl chloride, methanol, soda ash, acrylic acid, butyl acrylate and calcium carbide, among others.

“The government realized how fast they have been growing without any controls,” Ms. Bauza-Petrovic said. “The government has taken some measure to control this overinvestment.”

She added that China also has been lacking on development of innovative products. “They really have a lot of commodities, but not a lot of high performance products,” she said.

Much SR capacity, particularly for polybutadiene, had been idled, according to Ms. Bauza-Petrovic, who added about a half-dozen BR factories had been idled since year-end 2013, with some rationalization for EPDM and butyl rubber as well.

“The demand is good there, but it still isn’t growing as fast as the new supply,” she said. “Asia-Pacific is expected to continue being the fastest growing market for synthetic rubber. A lot of consumption will come from China, India and other Asian regions.”

Mr. Hyde said the addition of all the new SR capacity in China — particularly in 2013-14 — had some domino effect for producers elsewhere in the world. “Just like with styrene, there were guys selling polybutadiene into China that now don’t have a market for it,” he said.

“Now they’re looking for somewhere else to go, primarily the North Asian producers. That has caused some interesting dynamics that are good for some and bad for others.”

While China is roughly balanced on ESBR supply/demand, it will continue to need to import SSBR, particularly the high-end grades. “Nobody wants to build (an SSBR plant) in China,” Mr. Hyde said. “The technology leakage concerns keep you from building there.”

The IHS market analyst said if there remains any magic in rubber chemistry today, it’s in SSBR. “The producers — especially the ones who are upstream integrated into rubber — they guard jealously their solution SBR technology.”

He said the butyl rubber market, also in overcapacity, has had a new market dynamic emerge recently. Over the past couple of years, China now has the technology to produce halobutyl grades, which are used for tire inner liners. That puts pressure on the three non-Chinese companies that produce it: ExxonMobil, Arlanxeo and a Russian producer.

Ms. Bauza-Petrovic said that it’s not just in China where expansion plans have stalled. “We still are expecting growth in capacity, but not as before,” she said. “Since 2015, a lot of planned projects were canceled and some postponed.”

Many IISRP members that had announced new capacity have postponed the projects beyond 2020, she said, indicating that a number of those may never occur.

“I believe capacity additions have been coming, and demand has not picked up as fast,” Ms. Bauza-Petrovic said. “This slowdown is necessary to get some balance in the industry.”

ESBR situation

The ESBR sector has seen much activity that has kept it in the headlines.

The U.S. imposed antidumping duties on imports from Mexico, Brazil, South Korea and Poland. Mexico — home to ESBR producer Negromex, which is part of Dynasol Group — started its own ESBR dumping investigation on imports from Europe, South Korea and Thailand.

The Indian government also has imposed antidumping duties on imports from Europe, South Korea and Thailand.

In the middle of all this, East West Copolymer L.L.C. filed for bankruptcy and closed its Baton Rouge, La., facility. That factory was then sold first to Lion Elastomers L.L.C. and then to ExxonMobil Chemical. It is not expected to be reopened to produce ESBR.

Mr. Hyde said it will be several months before all of this shows up in trade data. But he said with East West being out of the picture, it puts U.S. rubber buyers in an interesting place.

“Now you have one pure merchant player in the U.S. in Lion,” he said. “The other pure merchant player in North America is Dynasol, and they have a 20-odd percent tariff. So you can buy from them, but you have to deal with the import duty.”

Goodyear also produces ESBR, supplying its own factories but also selling some on the open market. Mr. Hyde said Goodyear doesn’t discuss this much, but its “strategy seems to be to get rubber to its tire plants at the lowest possible average cost, whether that means buy it locally or internally.”

The Akron-based tire maker is a net buyer of ESBR on a global basis, so it buys and sells in the merchant market. “But if you’re a tire producer that’s not upstream integrated into rubber, you have one domestic supplier that is not a competitor of yours, and then you have importers.”

With much of the larger volume importing countries now under duties, that limits the options of ESBR buyers. He said one of the most interesting cases is the Synthos Group, which has operations in both Poland and the Czech Republic. It previously sourced U.S. customers from the Polish facility, but after the duties were enacted, Mr. Hyde said Synthos began exporting from the Czech Republic to the U.S.

“As a rubber buyer, I think you’re concerned for a number of reasons,” he said. “Primarily, you don’t want to be at the mercy of one (domestic) supplier.”

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?fit=336%2C221&ssl=1)