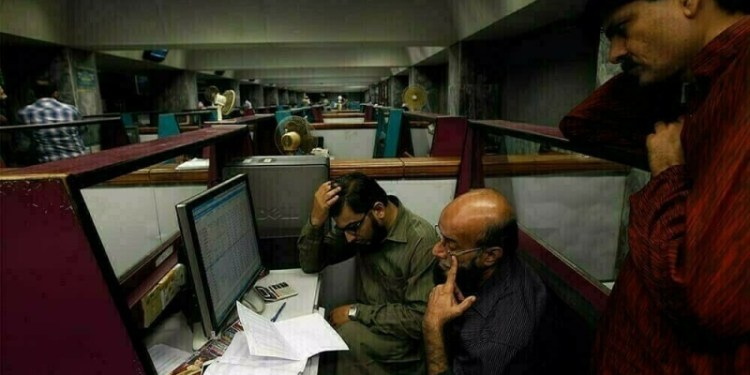

Massive selling pressure was witnessed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index settling was a loss of over 1,600 points on Thursday.

Negative sentiments prevailed at the bourse throughout the trading session, dragging the benchmark index to an intra-day low of 109,405.53.

At close, the benchmark index settled at 110,301.16, still down by 1,634.22 points or 1.46%.

“The market is seeing profit-taking, driven by both institutional and foreign sellers,” Sana Tawfik, Head of Research at Arif Habib Limited (AHL), told Business Recorder.

She added that uncertainty on the political front, both globally and locally, is also contributing to the selling pressure.

Concerns regarding shortfalls in meeting the International Monetary Fund (IMF) targets have also created a negative sentiment among investors, the market expert said.

The IMF mission is expected to reach Pakistan by the end of February or early March for the first review of the $7 billion Extended Fund Facility (EFF) programme.

Meanwhile, Saad Hanif, Head of Research at Ismail Iqbal Securities said that developments pertaining to the real estate sector are driving selling at the bourse.

The real estate sector, Monday, recommended the National Assembly Standing Committee on Finance and Revenue to amend “The Tax Laws (Amendment) Bill, 2024” for not asking the source of investment on property transactions upto Rs50 million.

“The recommendation, if implemented, may shift liquidity from equities to real estate,” Hanif told Business Recorder.

Moreover, the depreciation of the local currency and an increase in the import bill are denting sentiments, he added.

Selling was observed in key sectors including commercial banks, fertiliser, oil and gas exploration companies and OMCs. Index-heavy stocks including PSO, SHEL, SSGC, SNGPL, MARI, OGDC, POL, PPL, HBL, MCB, MEBL, NBP and UBL traded in the red.

“We think that investors are not finding current levels as attractive; top dividend yield (DY) stocks are offering barely 2 percentage point (ppt) higher yield over comparable government’s securities,” said Intermarket Securities, in a note earlier today.

The brokerage house projected the market to remain range-bound for the near term. “The upcoming IMF talks is a key milestone for future market direction,” it added.

On Tuesday, profit-taking at the PSX pushed the KSE-100 Index down by 810 points to close at 111,935.38.

The PSX remained closed on Wednesday in observance of the Kashmir Day holiday.

Internationally, Asia shares rose on Thursday, tracking gains on Wall Street following a see-saw session, while US Treasury yields came under pressure after mixed economic data.

Though many uncertainties remain under US President Donald Trump’s new administration, markets were relieved that things were not worse, particularly about the tit-for-tat tariff moves between the US and its major trading partners.

That helped lift global share markets and kept the dollar in check, giving some respite to its peers which had been heavily battered at the start of the week.

The People’s Bank of China (PBOC) on Thursday again set a stronger-than-expected yuan midpoint fixing, countering concerns it might allow the currency to slide to offset the impact of tariffs on the country’s exports.

China’s CSI300 blue-chip index reversed early losses to trade slightly higher, while the Shanghai Composite Index gained 0.13%.

MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.28%, while Japan’s Nikkei tacked on 0.28%.

Source: Brecorder