US2YT=X

-0.94%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

+0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

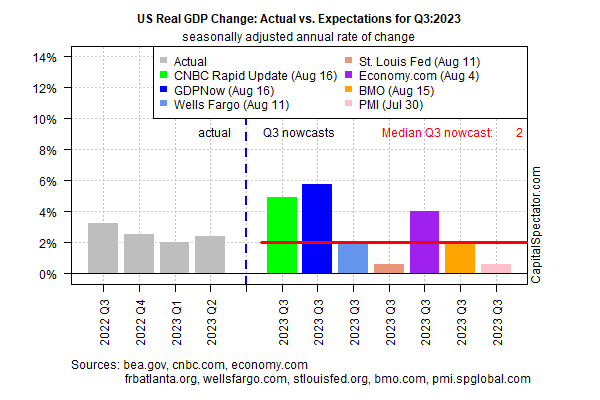

It’s been clear for some time that US recession risk has been sliding in recent months, but this week’s updates of a widely followed GDP nowcast published by the Atlanta Fed has been revised up – a lot – for the third quarter.

According to this model, the US economy isn’t just rolling along at a moderate pace — it’s surging.

US output is on track to increase 5.8% in Q3 for the real, seasonally adjusted annual rate, the GDPNow estimate for Aug. 16 shows. That follows the previous day’s sharply upgraded estimate of 5.0%.

If the current forecast for 5.8% is accurate, the economy’s growth rate is set to more more than double from Q2’s rise and will mark the strongest gain since 2021’s Q4.

Another nowcasting model published by Economy.com also shows a strong pickup in Q3 growth. This Aug. 15 estimate indicates output will rise 4.0% in the current quarter. While that’s far lower than the GDPNow estimate, it still ranks as a robust acceleration in economic activity.

Is it time to pop the champagne corks? Not yet. Although this pair of nowcasts paint a bullish picture for the economy that breaks to the upside vs. recent history, nowcasting models can be volatile, so incoming data could quickly reverse the latest upgrades in a flash.

The key question: How will other Q3 estimates fare in the days and weeks ahead?

My preferred nowcast monitoring tool is combining several estimates and tracking the changes, which is a more robust methodology for nowcasting than relying on any one model.

On that note, the pair of sharply upgraded nowcasts cited above have yet to move the needle in CapitalSpectator.com’s median estimate for the current quarter, which is still 2.0% for Q3 – unchanged from Tuesday’s update.

US Real GDP Change

US Real GDP Change

It may turn out that Q3 data is strengthening, but that’s still a dicey proposition. A more convincing sign would be if the median estimate in the chart above rises and, more importantly, remains elevated over the next several weeks.

A more convincing view at the moment is that the case for expecting a recession to start in the current quarter is virtually nil. Q4 and beyond are less clear, but it’s fair to say that the outlook for the near term is brighter.

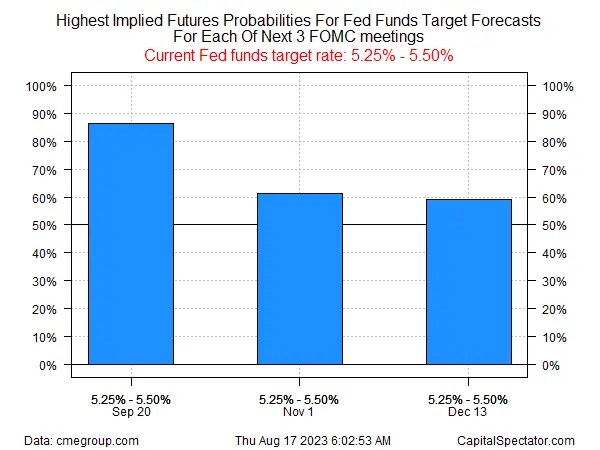

Keep in mind, too, that the Federal Reserve will be watching. If economic activity is picking up, that may translate into more rate hikes to head-off conditions that could revive inflation pressure and reverse the recent run of disinflation.

For the moment, Fed funds futures are still pricing in high odds that the Fed will leave rates unchanged at the next FOMC meeting on Sep. 20. Looking further out, however, it remains more or less a coin toss for expecting rates to hold steady.

Fed Funds Futures Probabilities

Fed Funds Futures Probabilities

The bond market seems to be picking up on the possibility that growth could be heating up and that the Fed may be forced to react. The policy-sensitive 2-year Treasury yield is trading near its high for the year. Meanwhile, the 10-year rate rose yesterday to a 15-year high.

UST10Y Daily Chart

UST10Y Daily Chart

If you were expecting a quiet end to the summer on the macro front, now’s a good time to revise your forecast.

Source: Investing.com

Discussion about this post