SINGAPORE (ICIS)–Spot butadiene (BD) prices in Asia are facing downward pressure in the near term amid weakness in China’s domestic market, and with deep-sea cargoes expected to boost regional supply.

On 7 July, prices were assessed stable week on week at $1,025/tonne CFR (cost and freight) northeast (NE) Asia, after gaining an accumulated $100/tonne over two consecutive weeks, according to ICIS data.

In China, which is a key import market for BD in Asia, domestic prices of the material had declined by yuan (CNY) 100-150/tonne ($15-22/tonne) from 3 July to CNY8,900-8,950/tonne DEL (delivered) on 10 July, according to the China editorial team at ICIS.

Chinese producer Liaoning Huajin Tongda cut its domestic offers by CNY500/tonne on Monday to CNY8,310/tonne.

Volatility in China’s domestic market had prompted buyers to retreat on expectations of lower prices, traders said.

“Chinese buyers now wait and will hold back their BD imports as they think that the import price should fall lower soon,” a trader said.

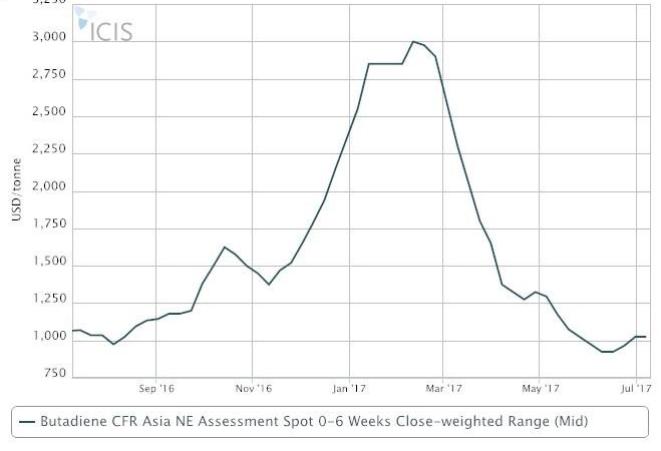

Spot regional BD prices had been on a four-month downward spiral from its peak of $3,000/tonne CFR NE Asia in early February, before staging a two-week rebound, according to ICIS data.

Current prices at an average of $1,025/tonne are down 66% from early February, based on the data.

“Chinese buyers now wait for price to fall to $950-1,000/tonne CFR NE Asia, as [tight] supply has eased,” another trader said.

BD supply in China is expected to lengthen when local producer Fushun Petrochemical restarts its 120,000 tonne/year BD unit by mid-July.

Sinopec Qilu Petrochemical’s 164,000 tonne/year BD unit restarted last week, while another local producer, Yangzi Petrochemical, resumed production on 7 July at one of its two 55,000 tonne/year BD units in Jiangsu province.

Regional supply, on the other hand, is expected to grow with the impending arrival of deep-sea material from Europe and the US, dampening the buying sentiment in Asia.

“There are more than 10,000 tonnes of deep-sea cargoes from Europe and the US which are expected to arrive in Asia in August,” a trader said.

In light of the lengthened supply, the price gap between buyers and sellers has widened to $50-80/tonne, a buyer said.

“Sellers are unwilling to sell below $1,050/tonne CFR NE Asia, while buyers only want to pay below $1,000/tonne CFR NE Asia,” a trader said.

BD is a key feedstock in the production of synthetic rubber, including styrene butadiene rubber (SBR) and polybutadiene rubber (PBR).

It is also used in the production of acrylonitrile butadiene rubber (ABS), which uses a smaller proportion of BD in its total composition.

Focus article by Helen Yan

Additional reporting by Alex Feng and Judith Wang

($1 = CY6.80)