HOUSTON (ICIS)–With global butadiene (BD) and rubber pricestumbling, sources said on Thursday they expect US November BD contracts to settle lower as well.

Early projections for the November contract were heard down as much as 5 cents/lb ($22/tonne), with most expecting some sort of decline.

“It could be down anywhere from 0 to 5 cents/lb, but down 5 cents/lb seems most likely,” a US buyer said.

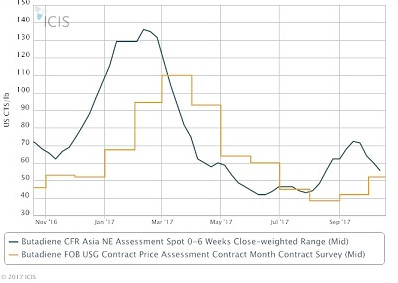

The October contract fully settled at 52 cents/lb on an FOB (free on board) basis.

“It will depend on how much the BD producers want to deal with the spot market,” the buyer said. “If they don’t lower the price enough, they could have extra volume they have to sell.”

Sources said that the US BD market is mostly balanced following disruptions caused by Hurricane Harvey, but supply is lengthening.

If US BD contracts are unattractive, sources said buyers could take contractual minimums, then look to domestic spot volumes at a discount to the contract or imports.

Driven by rapidly declining natural rubber (NR) prices, synthetic rubber prices in Asia have also fallen to keep pace and avoid losing market share.

Synthetic rubbers, such as styrene butadiene rubber (SBR), are a major downstream market for BD.

This has helped push Asian BD spot prices down around 18 cents/lb in the past four weeks.

“All the US producers are under pressure, especially at the end of the year, to keep imports to a minimum,” another US buyer said.

Market sources said that with demand levels for BD in the US starting to fall on seasonal factors, buyers can wait for a clearer floor to emerge, rather than needing to keep inventory levels higher.

Several sources also said US BD producers are about to start slowly gaining supply, on the start-up of several new crackers in the next several years.

“Producers will need to move that new BD, however minimal, which means contract terms could improve,” a source said. “Maybe we go from a situation with fees and adders to increased discounts.”

Major US BD producers include ExxonMobil, LyondellBasell, TPC Group and Shell Chemical.

- icis.com