LONDON (ICIS)–European styrene butadiene rubber (SBR) growth in 2019 is expected flat or limited despite numerous downstream investments in central Europe.

Hopes for growth, however, are pinned on recovery in the Asian market, although this is dependent on developments in the US-China trade war.

Hopes for growth, however, are pinned on recovery in the Asian market, although this is dependent on developments in the US-China trade war.

The European SBR market is adopting a more conservative approach for 2019, with market projections of growth ranging from flat to a 1.5% increase.

While growth in western Europe has been mostly stable over the last few years, central Europe’s growth in tyre manufacturing is a key area of focus for the market.

There have been several announcements for new tyre production in central Europe from companies such as Nexen and Apollo Tyres, which are expanding in this region.

Trelleborg, which previously acquired Mitas, is also investing in production in Serbia, while China’s Shandong Linglong Tire has also announced plans for a large tyre investment in Serbia in 2019.

These developments make central Europe a key region for Europe’s SBR, as the largest use for the material is in the manufacture of tyre products.

The replacement tyre market drives the majority of SBR demand, along with the original equipment manufacturer (OEM) market.

Replacement tyre sales figures were relatively stable in the first six months of 2018.

Other areas of possible growth highlighted include Turkey and North and South America, despite the currency crisis in some emerging markets in 2018.

“North [America] is still forecast at good GDP growth, while in South [America there] is a new mood of recovery, especially in the Brazilian economy” after the 2018 elections, an SBR supplier added.

UPSTREAM CONCERNS Market volatility in the upstream butadiene (BD) market is an area of concern for SBR players for 2019, however.

Most canvassed sources envisage balanced-to-long supply conditions in 2019 despite a heavy cracker turnaround period in the spring.

“[The] maintenance period in Q2 might slightly decrease the supply and make the market more balanced,” added a supplier.

Despite this, there is a view that supply levels will be sufficient in 2019 if the export arbitrage from Europe to Asia remains closed.

Throughout most of 2018, low natural rubber prices in Asia have weighed on synthetic rubber demand, limiting export demand out of Europe.

If the European BD market rebounds in the second quarter of 2019, imports into Europe from Asia could increase.

“It all depends on Asia, something which is the most critical factor … The first quarter [of 2019] will bring some answers,” said a distributor.

European players are waiting for the uncertainty surrounding the US-China trade war to unfurl in 2019.

In December 2018, a 90-day hiatus in tariff hikes was agreed between the Presidents of China and the US, Xi Jinping and Donald Trump, at the G20 summit in Argentina.

The market is waiting to see if Asian demand will pick up at the beginning of 2019, ahead of the Lunar New Year in February.

China’s automotive demand, and the wider economy, have slowed down, a factor which is adding to the general market uncertainty.

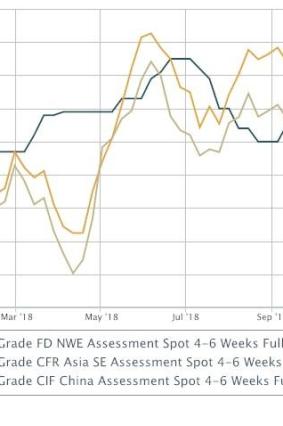

SBR prices in 2018 failed to reach the heights of 2017; consequently, 2018 was less volatile overall.

The EU-wide introduction of the Worldwide Harmonised Light Vehicle Test (WLTP) for emissions testing in vehicles on 1 September led to a surge in passenger car sales during the summer, ahead of the deadline, but automotive demand slowed sharply after this point.

By the end of 2018, however, demand in the automotive sector in Europe was recovering.

—

—

Top picture: A worker stacking tyres onto a truck at a Chinese tyre factory; archive image Source: View China Photo/REX/Shutterstock

Focus article by Melissa Hurley