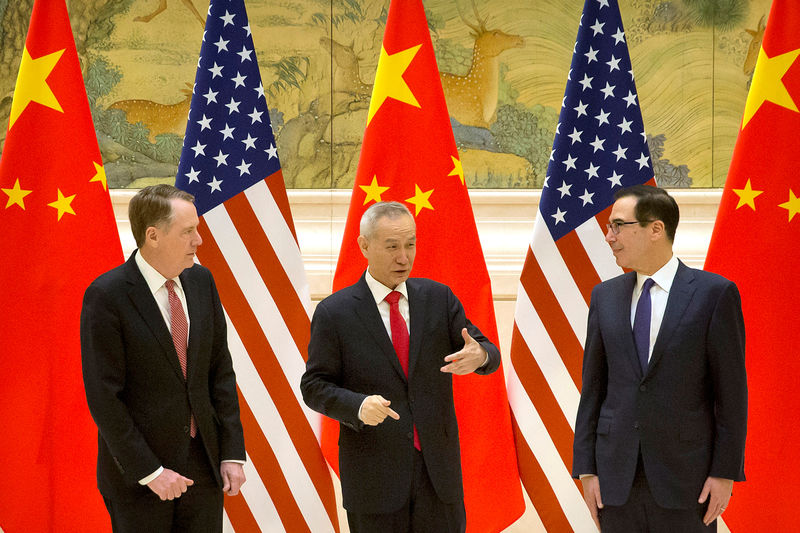

© Reuters. U.S and China trade talks in Beijing

© Reuters. U.S and China trade talks in BeijingWASHINGTON (Reuters) – U.S. Trade Representative Robert Lighthizer and U.S. Treasury Secretary Steven Mnuchin are in Beijing this week as Chinese and American negotiators try to hammer out a trade deal to ease a trade war and avert an increase in U.S. tariffs on Chinese goods scheduled for March 2.

The governments of the world’s two largest economies have been locked in a tit-for-tat tariff battle for months as Washington presses Beijing to address long-standing concerns over Chinese practices and policies around industrial subsidies, market access and intellectual property rights protections.

Here is a look at the key issues in the talks and their implications:

WHAT ARE WASHINGTON AND BEIJING FIGHTING ABOUT?

After years of steadily rising U.S. trade deficits with China and U.S. complaints that Beijing has systematically obtained American intellectual property and trade secrets through coercion and outright theft, the Trump administration last year demanded fundamental changes to China’s economic model to allow U.S. companies to compete on a more level playing field. These include an end to policies that Washington claims effectively force U.S. companies to transfer their technologies to Chinese partners and full protection for American intellectual property rights.

WHAT’S AT STAKE?

At the most basic level, a dominant position in future high-technology industries, according to the U.S. Trade Representative’s office. China is determined to upgrade its industrial base in 10 strategic sectors by 2025, including aerospace, robotics, semiconductors, artificial intelligence and new-energy vehicles. U.S. officials say they do not have a problem with China moving up the technology ladder, but they do not want it to happen with stolen or unfairly obtained American know-how. They argue that China’s massive support for state-owned enterprises is leading to overproduction, making it hard for U.S. companies to compete on a market-driven basis.

HOW DOES BEIJING VIEW THESE COMPLAINTS?

Chinese officials generally view the U.S. actions as a broad effort to thwart the Asian country’s inevitable rise to a dominant position in the global economy. They deny that China requires or coerces technology transfers, saying that any such actions are commercial transactions between American and Chinese firms. At the same time, China is looking to make a deal with President Donald Trump to ease U.S. tariffs on Chinese goods and to directly reduce the trade imbalance between the world’s two largest economies through increased purchases of U.S. goods, including soybeans and energy. Beijing has also taken some steps to open up to more imports, including lowering tariffs on imported cars and allowing foreign companies in some sectors to own a majority of their operations in China.

WHAT ACTIONS HAS THE UNITED STATES TAKEN?

Trump has imposed punitive tariffs on $250 billion worth of imported goods from China so far – a 25 percent duty on $50 billion worth of machinery, semiconductors and other technology-related products, and 10 percent tariffs on a broader, $200 billion range of goods that includes many chemicals, building materials, furniture and some consumer electronics. Thus far, Trump has spared many consumer goods, including cellphones, computers, clothing and footwear from tariffs. But if no deal is reached by March 2, the United States is scheduled to raise tariffs on the $200 billion in goods from China to 25 percent from 10 percent. Trump said on Wednesday that a delay was possible.

HAS CHINA RETALIATED?

Yes. China has imposed tariffs of 25 percent on $50 billion worth of U.S. goods, including soybeans, beef, pork, seafood, whiskey, ethanol and motor vehicles. Beijing also has imposed tariffs of 5 percent to 10 percent on another $60 billion worth of U.S. goods, including liquefied , chemicals, frozen vegetables and food ingredients. So far, Beijing has spared imports of U.S. commercial aircraft largely made by Boeing (NYSE:) Co. Since Trump and Chinese President Xi Jinping agreed in December to pursue the current round of talks, China has also suspended tariffs on U.S.-made autos and has resumed some purchases of U.S. soybeans.

WHAT HAS HAPPENED IN THE TALKS SO FAR?

China has pledged to make its industrial subsidy programs compliant with World Trade Organization rules and nondistortive to markets, but has offered no details on how it will achieve this, sources told Reuters. It’s unclear if that will be enough to satisfy U.S. negotiators, but that indicates China may be willing to address those American concerns.

The two sides seemed far apart on industrial subsidies and forced technology transfer when they met in late January, though they indicated some progress had been made around intellectual property rights issues.

A key U.S. demand is creating a mechanism for regular reviews of China’s progress on following through on any reform pledges that it makes, a plan that would maintain a perpetual threat of U.S. tariffs.

China has also offered to make purchases of over $1 trillion worth of goods over the next six years, including of agricultural and energy products as well as industrial goods.

WILL U.S. OFFICIALS ACCEPT A DEAL BASED MAINLY ON PURCHASES?

Trump has been optimistic about a deal, saying on Wednesday that the talks were going “very well”. But he indicated in his State of the Union address on Feb. 5 that big spending by China on American goods would not be enough for a deal. Any new trade deal with China “must include real, structural change to end unfair trade practices, reduce our chronic trade deficit and protect American jobs,” he said in the address.

The president’s advisers say he will not soften his demands that China make structural reforms on intellectual property and related issues. The United States rebuffed some initial offers by China last spring to increase purchases of U.S. goods, choosing instead to proceed with tariffs.

WHAT ARE POSSIBLE OUTCOMES OF THIS WEEK’S TALKS?

The two sides could report some progress toward a deal and may extend the March 2 deadline to keep negotiating, as often happened during talks last year to replace the North American Free Trade Agreement, or NAFTA. A stalemate on core structural issues would be viewed as a negative sign, and investors would brace for higher tariffs. Trade negotiations often go down to the wire, so a final outcome is not likely before the end of February, and any agreement will need the approval of Trump and Xi. The two presidents have no meeting planned before the March deadline.

Source: Investing.com