SINGAPORE (ICIS)–India’s styrene butadiene rubber (SBR) demand is expected to remain weak amid falling automotive sales and a slowing economy.

“The outlook is uncertain, with growth slowing down. Furthermore, Indian tyre makers have high inventories and demand for SBR is weak due to the declining auto sales and production, ” said an Indian rubber trader.

India’s vehicle production, domestic sales and exports all fell year on year in May, industry data showed on 11 June.

Vehicle sales in May fell by 8.6% to 2.0m vehicles while production fell by 7.9% year-on-year to 2.5m units.

Two-wheelers accounted for around 80% of production and 83% of overall sales for the month, according to the Society of Indian Automobile Manufacturers (SIAM).

SBR is a raw material used in the production of tyres for the automotive industry.

Trades were thin, with the downstream tyre makers holding back on re-stocking due to high inventories and weak market conditions.

Investor and consumer confidence have also been hit by the uncertainty surrounding the escalating US-China trade war and a slowing Indian economy.

India’s economy grew by 5.8% in the March 2019 quarter, marking a third straight quarterly decline and a sharp slowdown from the 6.6% pace recorded in October-December 2018, the Reserve Bank of India said.

“Yes, India demand for SBR continues to remain soft and low. Auto companies are reeling from overstocks and lack of sales pick-up,” an Indian synthetic rubber distributor said.

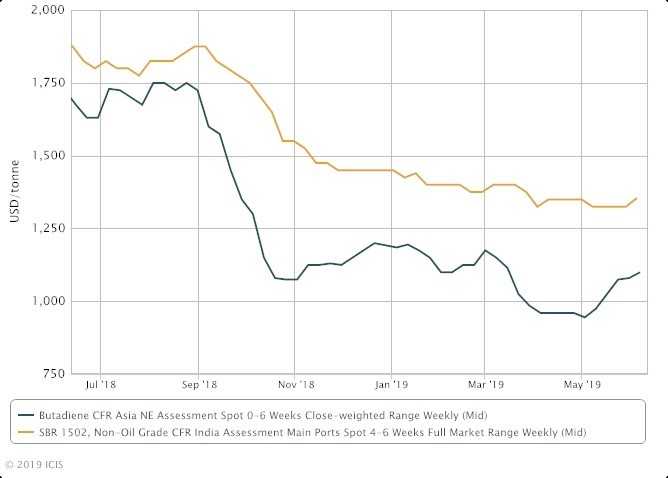

On 5 June, spot prices for non-oil grade 1502 SBR were up $30/tonne week-on-week at $1,330-1,380/tonne CFR (cost and freight) India, ICIS data showed.

“Asian SBR makers had no choice but to revise their offers up due to cost pressure and eroded margins, but there is resistance to any further price hike,” a supplier said.