Tokyo – Natural rubber (NR) prices have depicted a mixed picture, with markets still influenced by bad weather and supply concerns.

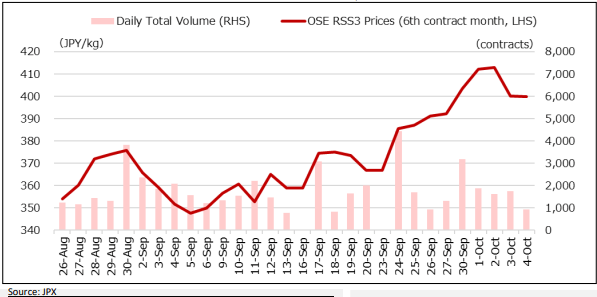

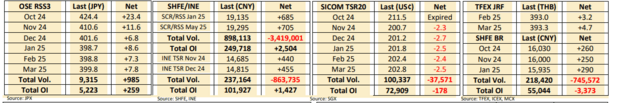

Over the trading week ended 4 Oct, Japan’s OSE March 2025 rubber contracts increased by 2.0% week-on-week on light, fresh buying interest, Japan Exchange Group (JPX) reported 7 Oct.

Meanwhile, in China, SHFE and INE markets gained 3.7% and 3.1%, respectively, ahead of the golden week holidays which started 1 Oct.

In contrast, SICOM January 2025 delivery contract declined by 1.2% week-on-week in active trading following the European Commission’s proposal to delay the implementation of the EUDR by an additional 12 months (ERJ report).

Physical rubber prices were also mixed during the period, with India’s RSS4 falling 4.3% week-on-week to $258.45/100kg, continuing a downtrend started at the end of Sept.

Meanwhile, Bangkok RSS3 rubber grade physical prices peaked at $300.64/100kg on 30 Sept, just before the Chinese week-long holiday, up from $287.23/100kg reported the week before.

Kuala Lumpur SMR20 rubber also traded slightly higher on 4 Oct at $209.3/100kg, up from $208.3/100kg the week before.