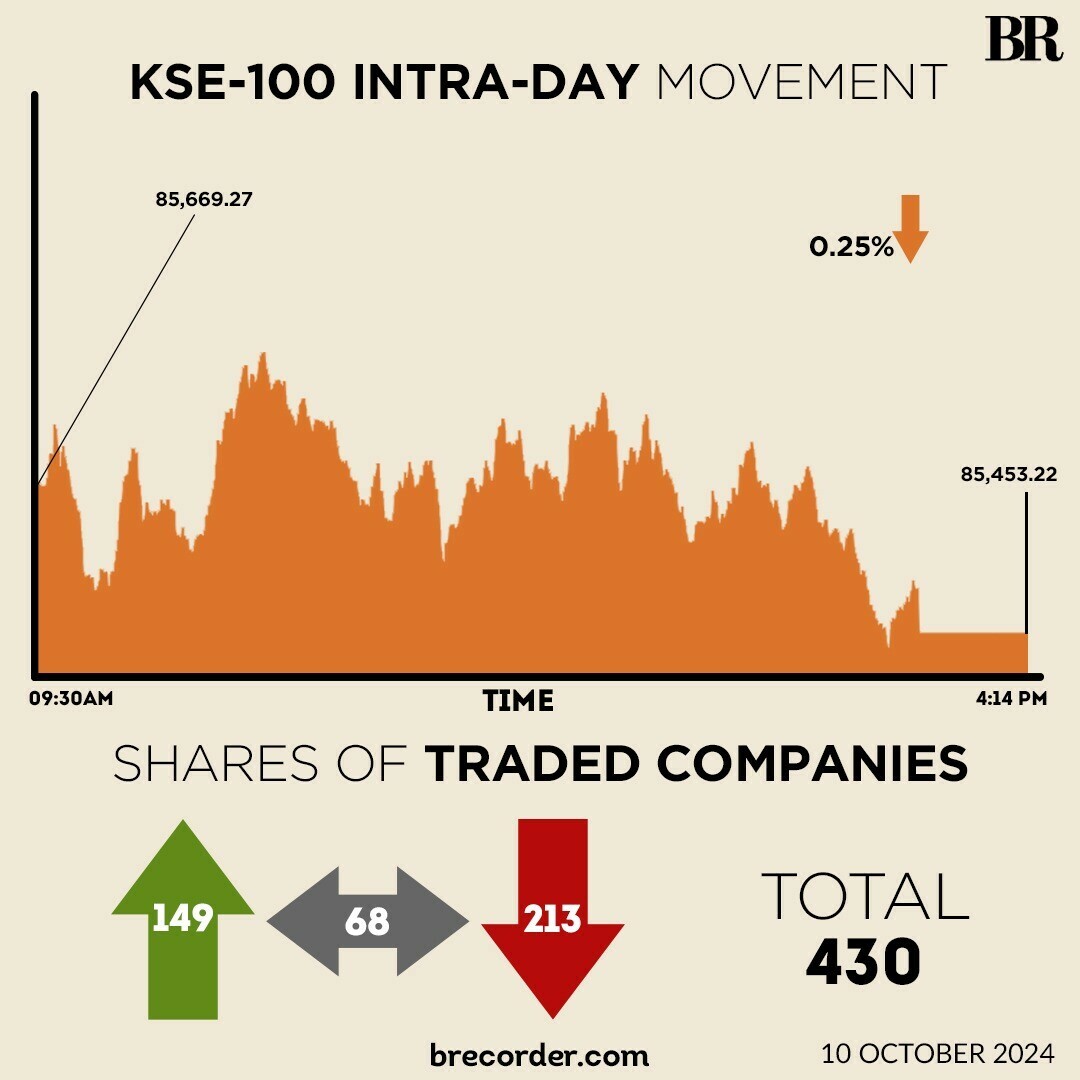

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index closed lower by 216 points or Thursday. The index swayed in both directions for most part of the day before closing marginally lower on late-session selling.

At close, the benchmark index settled at 85,453.22, down by 216.06 points or 0.25%.

“The KSE-100 index experienced a battle between bulls and bears today, with the bears ultimately emerging victorious,” brokerage house Topline Securities said in its post-market report.

“Two independent power producers (IPPs), HUBC and LPL, published material information that shifted market sentiment, as both IPPs will terminate their contracts early.

Additionally, HUBC announced that, pursuant to the terms of the agreement, the Government of Pakistan and the Central Power Purchasing Agency-Guarantee have agreed to settle the company’s outstanding receivables up to October 1, 2024,“ it added.

In a major development towards implementing reforms in Pakistan’s ailing power sector, the Federal Cabinet approved on Thursday the termination of existing Power Purchase Agreements with five Independent Power Producers (IPPs), as recommended by the Task Force on Power Sector Reforms.

In its notice to the PSX, Hub Power Company Limited (HUBCO), Pakistan’s largest Independent Power Producer (IPP), said the company had initialled a negotiated settlement agreement with the government.

Meanwhile, Minister for Investment of the Kingdom of Saudi Arabia, Sheikh Khalid Bin Abdul Aziz Al Faleh, said on Thursday that Saudi Arabia’s Manara Minerals would sign a deal with Barrick Gold and Pakistan’s State-Owned Enterprises (SOEs) in the coming few weeks.

The minister, along with a delegation of leading private sector companies from Saudi Arabia , arrived in Pakistan on a three-day official visit on Wednesday.

The Saudi minister also met Pakistan’s Chief of Army Staff (COAS) General Asim Munir to discuss matters of mutual interest, particularly initiatives to strengthen ever-growing brotherly bilateral cooperation in a variety of sectors, a Inter-Services Public Relations (ISPR) statement read.

Amid Pakistan’s improving economic indicators, the World Bank expects economic activity in Pakistan to continue recovering with real GDP growth estimated at 2.8% in FY25, an increase from the previous estimate of 2.3%. The World Bank made these projections in a report titled ‘Pakistan Development Update: The Dynamics of Power Sector Distribution Reforms’.

Globally, Asian stocks got a lift on Thursday from Chinese stocks as China’s central bank kicked off its 500 billion yuan facility to spur capital markets, while the dollar lingered near a two-month high ahead of US inflation data later in the day.

The People’s Bank of China (PBOC) said it would start accepting applications from financial institutions to join a newly created funding scheme, a plan it announced on Sept. 24 as part of a series of stimulus measures that drove Chinese stocks higher.

China’s blue-chip CSI300 index rose 1.7% in early trading, a day after dropping 7% as investors remained focused on the details of the stimulus measures from Chinese authorities to help revive the stuttering economy.

Hong Kong’s Hang Seng rose 2.5%, after slipping 1.3% on Wednesday and is up 24% this year.

That left MSCI’s broadest index of Asia-Pacific shares outside Japan 0.76% higher in early Asian hours. Japan’s Nikkei rose 0.5%.

The Pakistani rupee ended marginally weaker against the US dollar, depreciating 0.02% in the inter-bank market on Thursday. At close, the currency settled at 277.79, a loss of Re0.07 against the greenback.

Volume on the all-share index decreased to 503.75 million from 596.05 million on Wednesday.

The value of shares declined to Rs27.91 billion from Rs31.34 billion in the previous session.

PTCL was the volume leader with 52.24 million shares, followed by Hub Power Co.XD with 46.57 million shares, and PIA Holding Company with 25.51 million shares.

Shares of 430 companies were traded on Thursday, of which 149 registered an increase, 213 recorded a fall, while 68 remained unchanged.

Source: Brecorder