Pakistan Stock Exchange (PSX) returned to winning ways, as investors brushed off uncertainty over Republican candidate Donald Trump’s ascent to the White House, with the benchmark KSE-100 Index gaining nearly 500 points on Thursday.

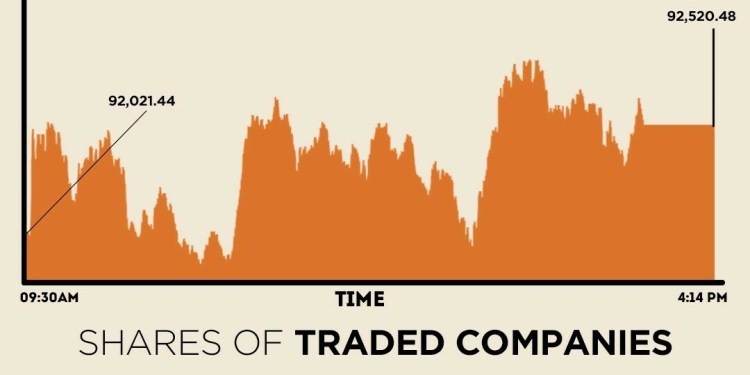

At close, the benchmark index settled at 92,520.49, up by 499.05 points or 0.54%.

On Wednesday, PSX failed to continue its bullish trend and closed in the red zone due to selling pressure as investors opted to book profit on available margins.

Buying spree returned to the bourse on Thursday as investors remained optimistic regarding positive macroeconomic fundamentals, experts said.

Expectations of a yield decline in the upcoming Treasury Bills (T-Bills) and the Pakistan Investment Bonds (PIBs) auction also contributed in the positive close on Thursday.

“The KSE-100 Index closed at 92,520, opening on a positive note and reaching an intra-day high of 673 points, driven by the recent Ijara Sukuk auction where by the cut-off yield on 1 year Sukuk fell to 10.99%, signalling a potential yield decline across all tenors in the upcoming T-bills and PIBs auction,” brokerage house Topline Securities said.

Following PM Shehbaz’s recent visit to Saudi Arabia, a delegation led by the power minister has been dispatched, with anticipated announcements of new Saudi investments, including Reko Diq as a likely flagship project.

“This development sparked investor interest in OGDC and PPL,” it added.

Leading the index surge on Thursday were ENGRO, DAWH, OGDC, HUBC, and EFERT, collectively adding 475 points. In contrast, major laggards—SYS, HBL, MEBL, KOH, and CHCC—together subtracted 173 points, Topline said.

In a key development, Morgan Stanley Capital International (MSCI) Inc., in the results of its November 2024 index review, announced the addition of 8 Pakistani companies as constituents on its Frontier Market (FM) Small Cap Index.

These companies include Citi Pharma, Crescent Steel & Allied Products, Fast Cables, Flying Cement Company, Pakistan Oxygen, Shifa International Hospitals, Thatta Cement Company and TRG Pakistan.

Meanwhile, the International Monetary Fund (IMF) staff, led by Nathan Porter, is scheduled to visit Pakistan between November 11-15 for a staff visit to discuss recent developments and Extended Fund Facility (EFF) programme performance to date.

Globally, Asia-Pacific equity markets were mixed on Thursday as investors weighed the implications of a Donald Trump presidency, while also eyeing monetary policy decisions from the US Federal Reserve and other major central banks later in the day.

The mixed reaction for Asian stocks was underscored in Japan as the tech-heavy Nikkei 225 reversed initial gains to be down 0.44% at 39,308.55 as of 0217 GMT, while the broader Topix remained up 0.88%.

Chinese markets, which lost ground on Wednesday due to the likelihood of higher tariffs under another Trump presidency, rebounded in the latest session.

Hong Kong’s Hang Seng rose 0.49% and mainland blue chips added 0.14%.

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Thursday. At close, the currency settled at 277.95, a loss of Re0.06 against the greenback.

Volume on the all-share index decreased to 678.79 million from 889.17 million on Wednesday.

The value of shares declined to Rs24.83 billion from Rs30.47 billion in the previous session.

B.O.Punjab was the volume leader with 62.92 million shares, followed by Kohinoor Spining with 46.53 million shares, and K-Electric Ltd with 34.72 million shares.

Shares of 449 companies were traded on Thursday, of which 257 registered an increase, 145 recorded a fall, while 47 remained unchanged.

Source: Brecorder