TOKYO : Rubber prices in Tokyo Commodity Exchange (TOCOM) and Shanghai Futures Exchange (SHFE) continue to remain weak as fall in crude oil prices and lackluster corporate profits in China signal a slowdown in the economy.

TOKYO : Rubber prices in Tokyo Commodity Exchange (TOCOM) and Shanghai Futures Exchange (SHFE) continue to remain weak as fall in crude oil prices and lackluster corporate profits in China signal a slowdown in the economy.

However, investors seem to be waiting for China’s Q3 GDP data due to be released on Thursday for further cues, according to Sreekumar Raghavan, Chief Commodity Strategist at Commodity Online.

In TOCOM, the key March 2013 futures contract fell 1.2 Yen per kg to 258.8 Yen with weak trade volumes in the evening session on Tuesday. At SHFE, the most active January contract fell 50 Yuan per ton to 25215 Yuan per ton in a declining trend this week.

Thailand Government has said that it will not sell procured rubber stocks unless prices rise. Rubber stocks held by the Thai government have doubled to 200,000 tonnes since mid-September. The Government has clarified that the stocks would be kept for domestic use, not sold on the world market.

The stocks jumped after the government approved an extra 30 billion baht ($976 million) to fund purchases when an initial budget of 15 billion baht ran out. Its intervention is aimed at boosting prices to help farmers.

Tyre sector demand remains weak globally although in US markets OEM tyre demand is set to rise while replacement tyres market is set to fall this year. European sales of new cars plunged by 10.8 percent in September from a year earlier, the European Automobile Manufacturers Association (ACEA)

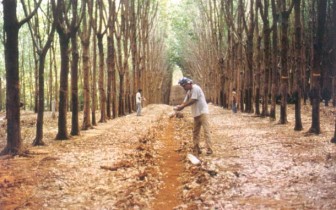

Source: Rubber Country